Everything You Need To Know About CA Intermediate Taxation Exam in 2021

CA Subjects Team Leverage Edu Updated on Jun 16, 2023 14 minute read Chartered Accountancy or commonly known as CA, is a professional course that equips one with technical knowledge to manage finance, accounting and taxation for an organization or any business entity.

CA Subjects and Syllabus 2021 CPT, IPCC & Foundation Leverage Edu

The ACCA syllabus (Association of Chartered Certified Accountants) consists of three stages: 1- The Applied knowledge stage which contains three exams; Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA). 2- The Applied Skills stage which contains six exams; Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR.

CA Subjects and Syllabus 2021 CPT, IPCC & Foundation Leverage Edu

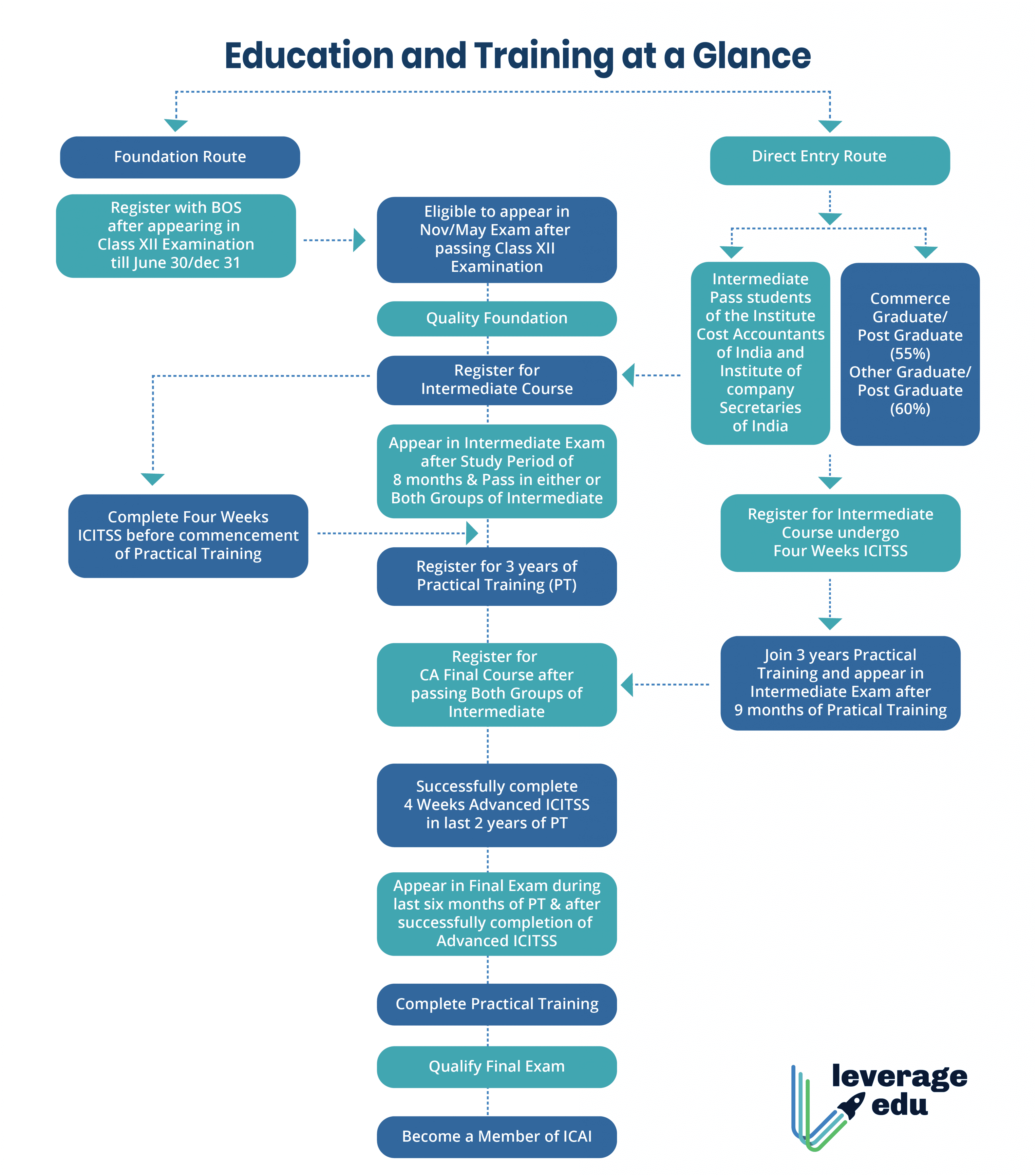

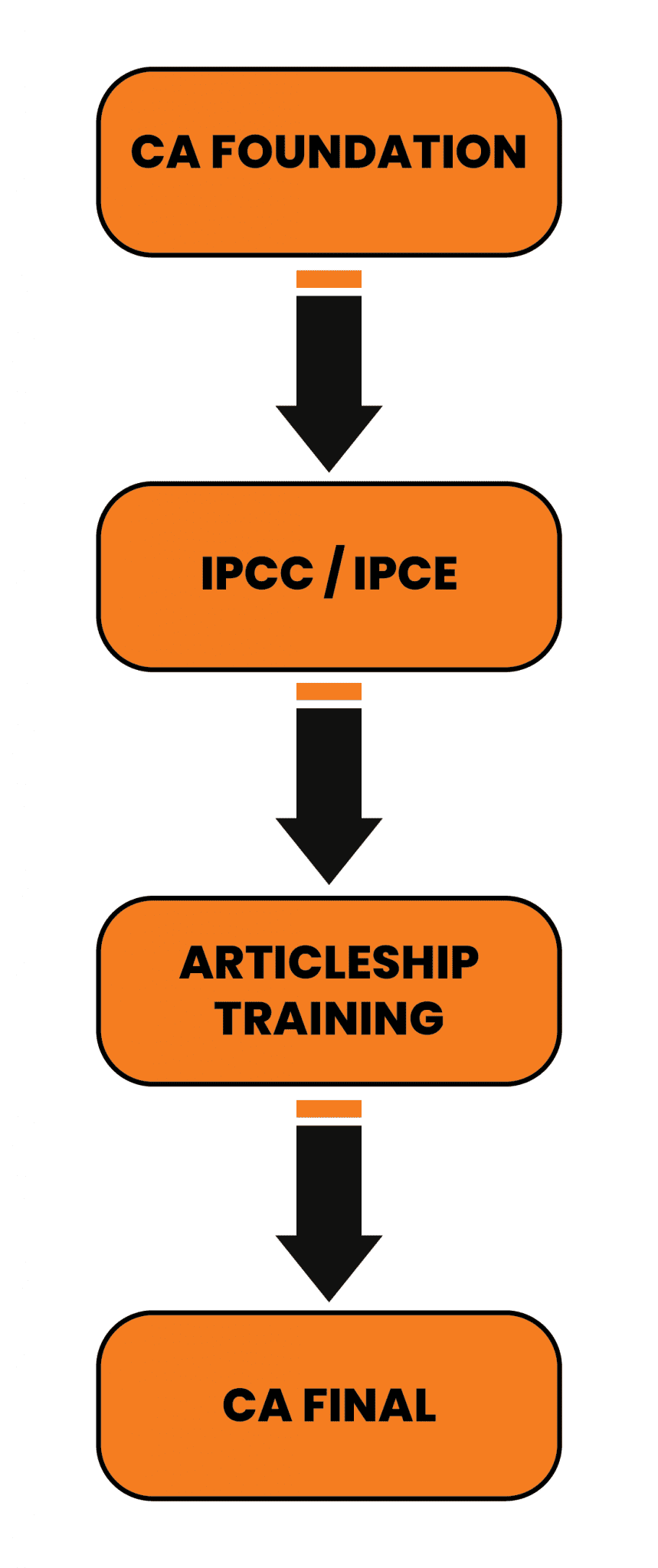

CA final exam can be attempted in the last 6 months of articleship training, including excess leaves, if any. After completing the articled training and passing both the Final Course groups with a minimum of 40% in each subject and 50% overall, a student can enroll as a member of ICAI and be designated as a CA.

CA Subjects List Explained in Detail

The CA Program includes two parts: the accredited Graduate Diploma of Chartered Accounting (GradDipCA) To complete the GradDipCA, you must successfully complete nine subjects (seven core and two electives), totalling 120 credit points. For important information on credit points, refer to the GradDipCA Course Information

How To Revise CA Subjects In 1.5 Days Between Exams CA Sahil Jain

The CA Program consists of nine subjects (seven core and two electives), in conjunction with three years of Mentored Practical Experience. Core 1: Ethics and Business Core 2: Risk and Technology Core 3: Financial Accounting and Reporting (FAR) Core 4: Tax (AU or NZ) Core 5: Business Performance Core 6: Audit and Risk

CA Subjects and Syllabus 2021 CPT, IPCC & Foundation Leverage Edu

What is Chartered Accountancy (CA) ? Chartered Accountant (CA) Course Who is a Chartered Accountant (CA)? Why Pursue a Professional Career in CA? CA Subjects List CA Subjects in CA Foundation Course or CPT (Common Proficiency Test) CA Subjects in Intermediate Course or IPCC (Integrated Professional Competence Course) CA Final Subjects

CA Intermediate Group 1 All Subjects Combo Classes

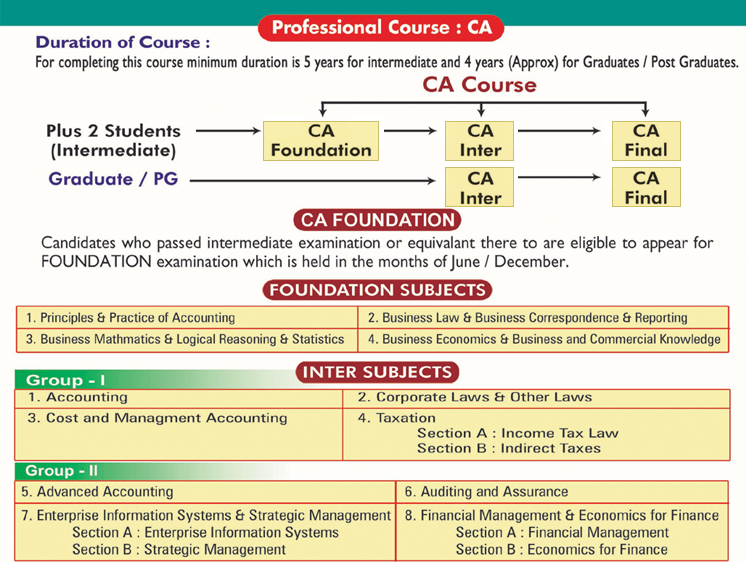

CA Syllabus and Subjects Overview The Chartered Accountancy (CA) course in India, governed by the Institute of Chartered Accountants of India (ICAI), offers a detailed CA Syllabus spanning three levels: Foundation, Intermediate, and Final. It equips aspiring CAs with expertise in accounting, taxation, auditing, business law, and more.

Grooming with CA Subjects

CA1 is one of the three Core Applications (CA) subjects that all students have to pass or obtain exemptions from. Visit Exam exemptions for more information about how to apply for exemptions from the professional exams. There are two opportunities each year to sit this exam: in April, and in September/October.

Join CA Chartered Accountancy Course at Modern Academy Vijayawada for

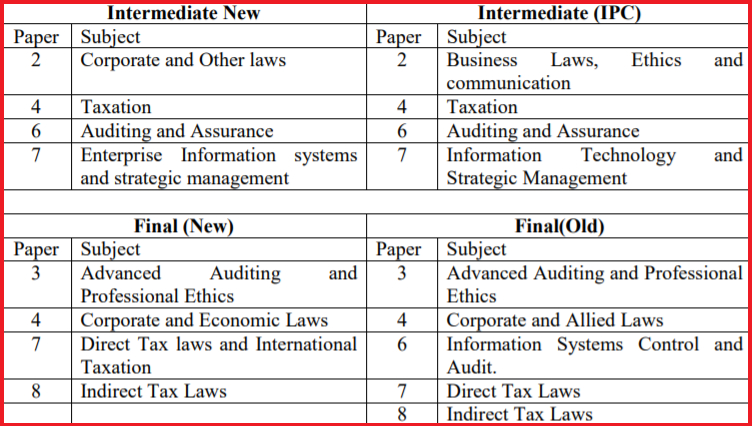

What Are the 8 Subjects in CA Inter? The Chartered Accountancy (CA) Intermediate level course comprises eight subjects that are divided into two groups. The subjects are as follows: Group I: Accounting Corporate and Other Laws Cost and Management Accounting Taxation Group II: Advanced Accounting Auditing and Assurance

CA Subjects and Syllabus 2021 CPT, IPCC & Foundation Leverage Edu

The UK is popularly known as the world financial center. Subjects like Accounting and Finance are studied by international students in rich and culturally varied areas. There are numerous career options and pathways available in this field, with chartered accountancy being one of the most popular. Becoming a Chartered Accountant UK will open many career prospects, from working as a financial.

.png)

Subjects of CA Intermediate COC Education

Institute of Chartered Accountants of Scotland (ICAS) To qualify as chartered and retain that status, they must: Pass a series of demanding accredited exams in financial management, auditing, business strategy and taxation, after a minimum of three years training. Get relevant work experience across a wide range of clients and industries.

Video 1 Introduction to CA subjects and Importance of Accounting

The 4 CA subjects list is as follows. Paper-1: Principles and Practice of Accounting. Paper-2: Business Laws and Business Correspondence and Reporting. Paper-3: Business Mathematics, Logical Reasoning and Statistics. Paper-4: Business Economics and Business and Commercial Knowledge.

CA Final Subjects and New Syllabus Revised for Nov 2019 Exams AUBSP

ICAI has notified the new CA Final syllabus under the new ICAI scheme on July 1, 2023. The first CA Final exam under the new syllabus of CA Final course will be held in May 2024. The last CA Final exam under the existing scheme will be held in November 2023 following the old CA final syllabus. Therefore aspiring students should take note of the.

ICAI Announces Big Changes In Chartered Accountancy Exams; 30 Per Cent

Taxation and Auditing Management and Banking CA Subjects and Syllabus A combination of innovative education and supervised work experience is required of successfully certified accountants. This aids in the development of analytical and interpreting skills and aids in the creation of dynamic solutions to business problems.

Characteristics of subjects with CA in the historical and prospective

CA Inter Subjects 2023 (New Course) Before moving the details of the CA Inter syllabus for November 2023, let's briefly look at the new CA Inter syllabus under the new scheme. New CA Intermediate Syllabus. As per the new CA intermediate syllabus released on July 1, 2023 by ICAI, the following 6 papers are included in it. The first CA Inter exam.

CA Subject List (Foundation, Inter, Final 2023)

You can become a Chartered Accountant (or CA for short) by choosing from a range of ICAS training routes, which includes options for school leavers, graduates, professionals and apprentices. To study with ICAS you don't need to have a degree or any previous accountancy or finance experience, and you'll earn a competitive salary whilst you.